Our Services

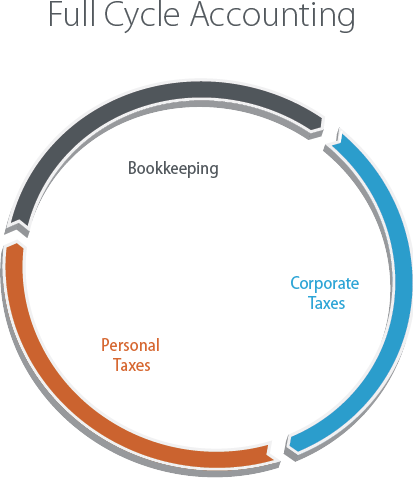

Bookkeeping

We take care of your accounting records so your information is up-to-date.

Corporate Tax

We prepare your tax and information returns along with your financial statements.

Personal Taxes

Personal taxes of owner/manager businesses tie closely to their corporations. By filing your personal tax returns as well, we can ensure that your personal tax planning is carried out.

We encourage adding bookkeeping to your corporate tax services so that we can work with you through the full accounting cycle.

Here’s why we’re great

From our small business to yours, we will treat you like family and make sure that you’re not only maximizing your tax deductions, but also planning ahead, combining your personal taxes and corporate taxes in the way that works for you, and doing it all with a smile on our faces.

Resources

We’re Hiring – Full-Time Junior Accountant

Junior Accountant About Us Sync Accounting, Chartered Professional Accountants is a public accounting firm located in beautiful Revelstoke, BC. We specialize in providing full-cycle bookkeeping, compilations and taxation services to individuals and owner/managed businesses. At Sync Accounting, we value work-life balance for our employees by offering flexible schedules. About The Role Compilations and tax preparation […]

We’re Hiring – Full-Time Bookkeeping Manager

About Us Sync Accounting, Chartered Professional Accountants is a public accounting firm located in beautiful Revelstoke, BC. We specialize in providing full-cycle bookkeeping, compilations and taxation services to individuals and owner/managed businesses. At Sync Accounting, we value work-life balance for our employees by offering flexible schedules. About The Role Bookkeeping is a key part of […]

Underused Housing Tax: Are you affected?

It’s important to note that although this new tax highlights non-residents of Canada, others may be at risk. Therefore, if you own or are on title for real estate, we suggest reading through the whole article!

Starting Your Sole Proprietor Business In BC

Welcome to part 3 of our “I’m Starting A Business: Now What?” series where we are walking you through sole proprietorship in British Columbia. More importantly, we’re going to show you how to set up your Sole Proprietor business.

Want to chat about your tax needs?

We offer customizable packages tailored to your unique situation.

That’s just one great reason to work with us.

Put yourself in the know.

Sign up to our newsletter

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Contact Information

Here’s how we’re qualified